Do you trade globally ?

Trade Finance

Improve cash flow by financing your supply chain costs so you can focus on growing your business.

- Home

- Trade Finance

Get a free, no obligation quote

The Problem We Solve

Trade barriers? We make cross-border deals secure and effortless.

Whether you're exporting goods abroad or importing products into your country, trade can be risky. Sellers need assurance that they'll receive payment, while buyers want to know their goods will be delivered as promised.

In fact, trade risks often prevent businesses from expanding into new markets. Without proper safeguards, the risk of non-payment, fraud, and disputes is high. That’s where Trade Finance comes in.

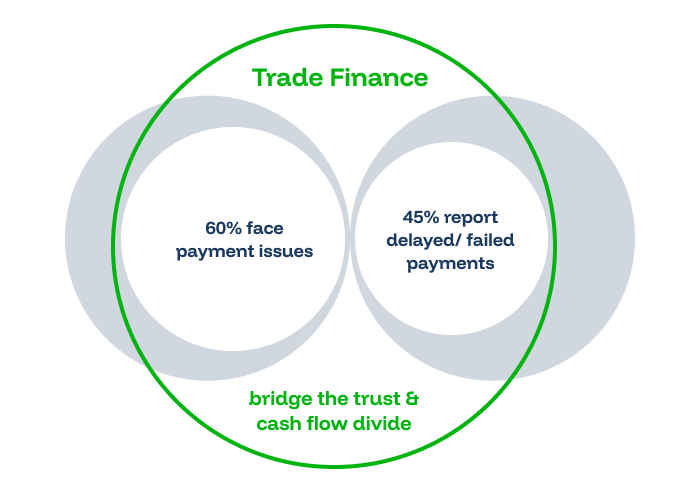

Of global SMEs face challenges with international payments and trust issues in cross-border trade (World Bank, 2023).

Of businesses report delayed payments or non-payment in international transactions (DHL Global Trade Barometer, 2022).

Our Solution

How Trade Finance Services Work

Trade finance: secure payments and reliable shipments for your business. With Trade Finance, both buyers and sellers can trade with confidence, knowing that payments and deliveries are securely managed by trusted financial institutions. Trade Finance acts as a safety net for businesses trading internationally or domestically. Here's how it works:

Agreement

The buyer and seller agree on a trade deal.

Credit

The lender issues credit guaranteeing payment once specific conditions have been met.

Shipment

The seller submits the required documents to the lender and ships the goods.

Payment Settlement

Once the documents are verified and conditions met, the lender releases the payment to the seller, ensuring both parties are protected.

Get a free, no obligation quote

Key Features & Benefits

Trade Finance is Essential for Your Business

Here’s why businesses worldwide rely on Trade Finance to simplify their cross-border transactions.

- Secure Payments - A Letter of Credit guarantees your payments, reducing the risk of non-payment.

- Improve Cash Flow - Extend payment terms up to 150 days, improving your cash flow without sacrificing business operations.

- No Collateral Required - Unlike traditional loans, Trade Finance doesn’t require you to pledge collateral that could affect your existing credit lines.

- Pay-As-You-Go - Enjoy flexibility without upfront costs or hidden fees. Use the service only when you need it.

- Global Reach - Trade with confidence, knowing that you can securely work with international partners regardless of location.

Scenarios For Success

Tapping Into Global Supply

Get a free no obligation quote

Work With Inspire Match

The Global Way to Scale

Inspire Match works with a wide range of lenders and can connect you with the best trade finance provider for your business needs.

Here's why we’re the right choice:

Tailored Solutions

We take the time to understand your business and match you with the most suitable lender.

Fast & Simple

Get a quote and access funds quickly with no hidden fees.

Flexible Payment Terms

Increase supplier payment terms.

No Collateral

Protect your existing credit lines, trade finance doesn’t require any collateral from you.

Get a free no obligation quote

Still Have Questions?

We're here to help

Trade Finance ensures that both parties in a trade agreement are secure. A Letter of Credit issued by the buyer’s bank guarantees payment to the seller once conditions are met.

There are no hidden fees or upfront costs. You only pay when you use the service, and our team will provide clear details of all associated fees before you proceed.

No, Trade Finance does not require you to pledge collateral, allowing you to maintain your credit lines.