Quick and Flexible Short-Term Loans

Flexi Fund

Fuel your business growth with short-term loans from £1,000 up to £1,000,000 and seize opportunities or manage cash flow without the long-term commitment.

- Home

- Flexi Fund

Get a free no obligation quote

The Problem We Solve

Cash flow challenges slowing your growth?

Business owners often face unexpected expenses or growth opportunities that require quick funding. Traditional loans can take weeks or even months to process, which isn't always feasible when time is of the essence.

Short-Term Business Loans provide the flexibility and speed that you need to keep your operations running smoothly, manage cash flow, or invest in immediate opportunities, all without committing to long-term financial obligations. We provide quick access to funds when you need them most.

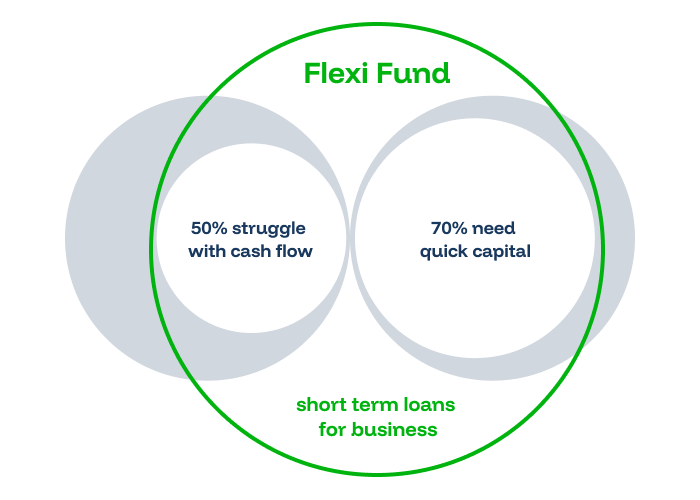

Of small businesses experience cash flow problems at some point during their operations (QuickBooks, 2022)

Of business owners cite access to fast capital as key to seizing new opportunities and managing challenges (Fundera, 2022).

Our Solution

How Flexi Fund Services Work

Simple, fast, and flexible short-term loans for your business needs. This fast and efficient process ensures you can get the capital you need without the hassle of lengthy approval times or long-term commitments.

Application

Apply online, specifying the amount needed and the purpose of the loan.

Approval

The lender evaluates your business’s financial standing and approves your loan.

Funding

Upon approval, you receive the funds, often within just a few days.

Repayment

Repay the loan in regular installments, including interest, over the term.

Get a free no obligation quote

Key Features & Benefits

Why Use Our Flexi Fund Service?

Short-term loans are the flexible solution your business needs to grow and thrive.

- Fast Access to Funds - Get approved and receive the funds within days, not weeks.

- Flexible Loan Amounts - Borrow anywhere from £1,000 to £1,000,000 based on your business needs.

- No Early Repayment Penalties - Repay the loan early without incurring extra fees, saving you money in interest.

- Simple Application Process - Apply easily through an online application and receive approval in as little as 24 hours.

- Short-Term Commitment - With repayment periods ranging from a few months to a couple of years, you’ll avoid long-term debt while still addressing immediate needs.

Scenarios For Success

Snip, Style, Scale: Unlocking Growth

Get a free no obligation quote

Work With Inspire Match

The Fastest Way to Fund Your Future

Inspire Match works with a variety of trusted lenders to connect you with the best loan options for your business.

Here’s why we’re the right choice:

Tailored Solutions

We understand that every business has unique needs, and we’ll connect you with the right lender for your specific situation.

Rapid Application

Apply online in just a few minutes, and get approved within 24-48 hours during business days.

No Hidden Fees

You won’t encounter any upfront costs or early redemption fees, giving you peace of mind.

Flexible Loan Terms

Borrow as little or as much as you need, with repayment options that fit your business’s cash flow.

Still Have Questions?

We're here to help

Approval typically takes less than 24 hours, and funds can be disbursed within days. It may take up to 48 hours on business days for more complex loan types.

No, you can repay the loan early without incurring any additional fees.

You can borrow from £1,000 to £1,000,000 depending on your business’s needs.